ODYSSEY FINANCIAL TIPS & ADVICE

Welcome to Odyssey’s blog which is packed full of relevant news articles and general information that may be of benefit.

What is the fixed-rate cliff and how can refinancing help?

You’ve probably heard the term “fixed-rate cliff” bandied about in finance news feeds. But what is it? And if you’re about to head over it, how can you prepare for a soft landing? A […]

Mortgage holders granted a reprieve as RBA puts interest rates on hold

And … exhale. After 10 straight rate hikes the Reserve Bank of Australia (RBA) has today decided to put the official cash rate on hold. But for how long? The decision to keep the […]

Money habits that may raise lenders’ eyebrows

We all know being on our monetary best behaviour can help to land a home loan. But did you know there are common spending habits you may have that are red flags to lenders? […]

Time to jump in? First home buyer deposit saving times plunge

Home loan headlines have been, let’s face it, a bit of a downer of late. But the good news is that first-home buyers are now reaching their 20% deposit goal faster. First home buyers […]

Got an eagle eye on house prices? Rate rises are only part of the story

Rate rises can affect the property market, as we’ve all seen of late. But there are other factors that appear to hold longer-term sway over national house prices. In a bid to bust inflation, […]

Homeowners feel the pinch as RBA lifts cash rate to 3.60%

The Reserve Bank of Australia (RBA) has increased the official cash rate for a tenth straight meeting, taking it to 3.60%. How much will this rate hike increase your monthly mortgage repayments, and how […]

The latest twist in the tale of national property prices: explained

The property market has had more plot twists than a daytime soap opera in recent years. So getting the skinny on current trends is helpful when you’re planning to buy. Here’s the lowdown on […]

Take the heat off rate hike fears with these 4 tips for buyers

Have recent rate hikes made you nervous about taking the plunge into the property market? You’re not alone; it’s a buyer’s market for a reason. Here’s how to stay cool and calm when buying […]

How to prepare for a fixed-rate mortgage cliff

Do you have a fixed-rate mortgage contract that’s coming to an end soon? It can be a stressful time, particularly with rate rise news dominating the headlines. So today we’ve got some tips for […]

RBA hikes the cash rate for the ninth time in a row, to 3.35%

The Reserve Bank of Australia (RBA) has kicked off 2023 by increasing the cash rate a further 25 basis points to 3.35%. How much will this rate hike increase your mortgage repayments in 2023, […]

Considering refinancing your mortgage? Here are some questions to ask

Home loan not up to scratch? Looking for a better rate? Or do you want to unlock equity? Then refinancing could be for you. But there are some important questions to ask first. If […]

Can a job switch affect your mortgage application?

Changing jobs may offer more perks – higher income, greater fulfilment, and the opportunity for growth are often things people look for in a new gig. But could it also impact your mortgage application? […]

Planning a reno in 2023? Here are 4 tips for smooth sailing

Having a spruced-up home feels great. And it can also boost your home’s value. But, as exciting as the prospect of rolling up your sleeves and getting on with a reno can be, there […]

Get a financial head start on the school year

Finding the time to delve into your finances can be a struggle. But the school holidays can offer the perfect time, especially for teachers. Get cracking on your financial to-do list these holidays by […]

What you should know about buying a tenanted investment property

Buying a rental property is a popular way to invest. But where do you stand if the property you’re eyeing off already has a tenant? We’ll fill you in on what you need to […]

4 New Year’s resolutions for financial fitness

As the sun rises on January 1, many Australians will be getting started on their new year’s pacts. The gym will be full of determined resolution keepers; the pavement pounded by brand-new sneakers. But […]

Seasons greetings! Here’s to a happy and prosperous 2023

End-of-year festivities have snuck up on us! Wishing you and yours a swell Noel and a wonderful new year. It’s time to dust off that kitsch Christmas t-shirt, deck the halls, and give Bing […]

First home buyer numbers have halved: is it time to swoop in?

Repeated cash rate hikes have put many first home buyer plans on hold. So could you swoop in and reap the benefits with less competition in the market? In case you missed it, from […]

Are we there yet? RBA hikes cash rate for eighth straight month to 3.10%

The Reserve Bank of Australia (RBA) has driven the cash rate up by another 25 basis points to 3.10%. Find out how much this final cash rate hike of the year has increased your […]

Where there’s a will (and genuine savings), there’s a way

Inheritances can be a bittersweet part of life. But an inheritance alone won’t always cut it when applying for a home loan. Having genuine savings can help show lenders you’ve got what it takes […]

Your new phone or your home loan? What would you research more?

What’s more important: your new phone or your next home loan? Well, we were stunned to see a recent survey that showed Australians put more effort into researching phone plans than they did their […]

5 surprising reasons for home loan heartbreak

Whether it’s your love life or your home loan application, no one likes getting rejected. There are many reasons why it could happen, and some can come as a big shock. So today we’ve […]

Buying could be cheaper than renting for a third of properties

For many Australians, rate hikes and inflation have made the dream of property ownership feel ever more distant. But a recent analysis shows that meeting mortgage repayments could actually be cheaper than renting for […]

Hold your horses: RBA hikes cash rate again to 2.85%

Whoa, Nelly! The Reserve Bank of Australia (RBA) has lifted the official cash rate again, this time by another 25 basis points to 2.85%. How much will this rate rise increase your monthly mortgage […]

With property prices dropping, is now the time to refinance?

You may have heard that property values are on the decline. But what does this mean if you’re planning to refinance? We’ll discuss how falling housing prices may affect your refinancing application and what […]

Is now a good time to buy an investment property?

You’ve bought a home. And now you might be considering adding an investment property to your portfolio. But have recent interest rate hikes cooled your heels? We’ve outlined reasons why now may still be […]

Nurses and midwives now eligible for LMI waiver

Nurses, midwives and other important healthcare professionals can now qualify for a lenders mortgage insurance (LMI) waiver policy. Here’s how it could save them thousands and fast-track their journey into home ownership. Are you […]

RBA lifts cash rate for the sixth month in a row to 2.60%

The Reserve Bank of Australia (RBA) has hiked the official cash rate by another 25 basis points to 2.60%. How much will this rate hike increase your monthly mortgage repayments, and when will it […]

How to escape renting and get into the property market

The recent decline in rental properties has caused many to feel uncertain about their housing situation. Here’s how you can leave renting in the dust and make homeownership a reality. Dwindling rental supplies in many parts […]

How long does it take for an interest rate rise to kick in?

Household budgets around the country are feeling the brunt of five back-to-back rate hikes. And we’ve been warned more are on the way. But just how long does it take for each rate rise […]

Is now a good time to buy?

Recent back-to-back interest rate hikes have led to a cooling of the property market, and with more rate rises predicted, you may feel like pumping the brakes on purchasing. But could the current climate […]

RBA hikes the cash rate for fifth straight month to 2.35%

The Reserve Bank of Australia (RBA) has hiked the official cash rate by another 50 basis points to 2.35%. Here’s how much you can expect to pay on your mortgage going forward and how […]

What happens when you roll off your fixed-rate mortgage?

They say all good things come to an end, and that includes your ultra-low fixed-rate home loan period. So what can you do to ensure a smooth transition? With the past couple of years […]

Property prices are predicted to dip: 5 ways you can prepare to buy

Property prices are predicted to fall over the coming year, but it’s always hard to know exactly when they’re going to start trending back up again. So if you’re interested in taking advantage of […]

Could an eco reno boost your property’s value?

You’ve probably heard that interest rates are on the rise and national property prices are on the way back down. Here’s how you can kill two birds with one stone: by refinancing to unlock […]

Why you might want to refinance sooner rather than later

Thinking about refinancing? As interest rates rise, so do the hurdles you need to clear. Here’s why you might want to look at refinancing soon to avoid potentially missing out. When was the last […]

Interest rates to keep climbing as RBA hikes cash rate to 1.85%

The Reserve Bank of Australia (RBA) has increased the official cash rate by another 50 basis points to 1.85%. Here’s how to hang in there and keep up with all these monthly cash rate […]

Keep calm and carry on: 5 ways you can absorb interest rate rises

We’ve seen interest rates bounce back up over the past three months, and most economists are predicting more increases to come. If you’re starting to worry about your finances, rest assured there are several […]

Renovate or invest? How 7-in-10 Aussies are using their equity

Seven in 10 homeowners have recently used the equity in their home to renovate, invest in property or shares, or boost their superannuation. Have you thought about how you could take advantage of last […]

The tax on luxury cars just got a little cheaper

Got your eye on a luxury car that’ll make your mates jealous? Or perhaps something that’s a little more fuel-efficient and environmentally friendly? Today we’ll run you through a new tax change that could […]

Single and under 30? You’re a great fit for the 5% deposit scheme

Single Australians under 30 snare the lion’s share of spots in the federal government’s 5% deposit first home buyer scheme, according to new data. Here’s how to secure one of the highly coveted 35,000 […]

RBA lifts cash rate for the third month in a row to 1.35%

The Reserve Bank of Australia (RBA) has increased the official cash rate by another 50 basis points to 1.35% amid continuing inflation pressures. How much will this third consecutive rate hike increase your monthly […]

Financial hardship arrangement reporting is about to change

With interest rates on the way back up, there’s no doubt some households around the country are starting to do it a bit tough. Coincidentally, some big changes kick in on July 1 when […]

Want a first home buyer scheme spot? Here’s how to get the inside lane

We’re just days away from 35,000 first home buyer scheme spots becoming available on July 1. If you’re keen to snare a place in the scheme – and buy your first home sooner – […]

No more Mr Nice Guy: the ATO wants its money

Tax time is just around the corner and the ATO has sent out a warning to businesses around the country that owe it money: the COVID-19 moratorium on debt collection has come to an […]

Refinancing numbers are surging across the country, here’s why

Rising interest rates got you feeling a little vulnerable? It might be time to take some control back by refinancing or asking for a rate review. Here’s why we’re seeing refinancing numbers surge across […]

RBA increases cash rate for second consecutive month, to 0.85%

The Reserve Bank of Australia (RBA) has increased the official cash rate by 50 basis points to 0.85%. How much extra should you expect to pay on your home loan? Today’s cash rate hike […]

Banks tighten lending, reducing the maximum you can borrow

Some of Australia’s biggest banks have tightened their mortgage lending criteria, meaning you might not be able to borrow as much from them. How might this affect your next purchase? This week ANZ lowered […]

Bulk of SMEs preparing for growth over next 12 months: research

Small businesses around the nation are once again confident about their future and ready to start driving toward their next phase of growth, according to new research. The research, carried out by small business lender […]

ATO hit list: rental property income and capital gains

Property investors beware: the Australian Taxation Office (ATO) has revealed the four key areas it will be targeting this tax year, and rental property income/deductions and capital gains are high on the hit list. […]

The two major parties’ first home buyer policies explained

Housing affordability is one of the key battlegrounds ahead of the federal election this Saturday. So what is each of the two major parties proposing to help first home buyers crack the market? Let’s […]

EOFY alert! Financial year-end is fast approaching

Small business owners wanting to buy a vehicle, asset or important piece of equipment and immediately write off the cost have just over a month to act this financial year. There’s nothing like an […]

Ready for lift-off: how to prepare a buffer for more rate rises

Rate rises are a bit like taking off in a plane. Sure, it’s a bit nervy, but so long as you’ve run through your pre-flight check, have a well-serviced aircraft, built-in some contingencies (a […]

RBA increases cash rate to 0.35% amid high inflation concerns

The Reserve Bank of Australia (RBA) has increased the official cash rate by 25 basis points to 0.35% amid high inflation concerns and has signalled more cash rate increases will likely follow. This is […]

SMEs invest in machinery, IT and energy-efficient assets for growth

Australian small businesses are investing in their recovery through a surge in machinery purchases, IT and office technologies, and sustainable business assets, according to Commonwealth Bank (CBA) data. The CBA research shows small business financing for […]

Brace yourselves: a May rate hike might be coming next week

The chances of the Reserve Bank of Australia (RBA) lifting the official cash rate on Tuesday just increased dramatically after figures showed the cost of living jumped 5.1% over the past year – the […]

Attention first home buyers! Price caps increase for 5% deposit scheme

First home buyers with a deposit of just 5% will soon have more purchasing power thanks to an increase in property price caps for the highly popular Home Guarantee Scheme. Most capital cities will […]

How to avoid becoming a victim of underquoting

It’s the hope that kills you. Just ask Carlton fans, NSW Blues supporters, Wallabies sufferers, and hopeful homebuyers who have fallen victim to underquoting. Obviously, you can’t change your footy team, but you can […]

What the!? Tesla came third on the new vehicles sold list?

Car enthusiasts around the nation got a bit of a shock this week when the Tesla Model 3 rocketed up the sales leaderboard to place third for all new vehicles sold in March. How […]

How to save a first home deposit in just over a year

It’s taking young couples roughly five years on average to save for a 20% home loan deposit, according to new research. Want to hear something crazy, though? We know how to quarter that timeframe… […]

Budget winners: first home buyers, regional buyers, single parents

First home buyers, regional buyers and single parents keen to crack the property market are the big winners in this year’s federal budget – with 50,000 low deposit, no LMI scheme spots up for […]

How much have car prices gone up since the pandemic began?

Most of you would have noticed that car prices have gone up significantly over the past two years. But how much have they gone up exactly? Let’s take a look. You’re not imagining things […]

16 ways the government should tackle housing affordability: report

Think property prices have gone a little bonkers? You’re not the only one. Which is why a report with 16 recommendations to tackle housing affordability has just been plonked on pollies’ desks in Canberra. […]

What’s your debt-to-income ratio? And why do lenders care about it?

New data from the lending watchdog reveals almost one in four new mortgages are risky. How are they deemed risky? Well, it’s got something to do with your debt-to-income ratio, which we’ll explain in […]

Flood victims can defer loan repayments for up to 3 months

Home and business owners impacted by the floods in New South Wales and Queensland can apply to their lender for a three-month loan deferral or reduced payment arrangement. Here’s how to apply if you […]

Which two capital cities might have just hit their property price peak?

It’s a three-speed property market across the country right now, with two capital cities showing signs prices might’ve peaked, three cities looking like they could soon peak, and three still going strong. How is […]

Thought about buying an EV? Interest rates for them are dropping

It wasn’t long ago that the idea of buying an electric vehicle (EV) seemed like a bit of futuristic science-fiction. But with interest rates on EV loans recently dropping to under 3%, going electric […]

Where are tradies most in demand at the moment?

Keen to tackle a renovation project in 2022? You might have noticed that tradies are hard to pin down at the moment. So if you live in one of the suburbs in this week’s […]

Fixed rates on the rise, as CommBank tips a June cash rate hike

Hold onto your hats, things are about to get a little bumpy. Economists from Australia’s biggest bank are predicting the Reserve Bank will raise the official cash rate as early as June – and […]

Flexibility emerges as a key priority for small business loans

What’s most important to you when selecting a lender to provide finance for your small business right now? Well, Australian small business owners have put ‘flexibility’ when it comes to loan repayments right up […]

Why are houses becoming so much more expensive to build?

Construction costs just rose at the fastest annual pace since 2005. So why is it getting so expensive to build your own home? Today we’ll look at the materials that are becoming more expensive […]

Which cities are expected to have the biggest price growth in 2022?

National property prices are predicted to rise by up to 9% in 2022, according to REA Group, but which cities are tipped to lead the way in price growth this year? Let’s take a […]

One in five young adults are saving to start their own business

Ever dreamed about telling your boss to “shove it” and starting up your own business? Well, there’s been a big jump in Millennials and Gen Zs who are saving up to do just that […]

Your suburb’s 2021 property report card is in

With all the talk of record-breaking property growth throughout 2021, do you know how exactly your suburb and property type performed? Today we’ll show you how to find out in just a few clicks. […]

Borrowing soars: average loan up almost $100,000 in 12 months

How much do you need to borrow to buy a typical Australian home these days? Well, the average loan size has increased dramatically over the past year – up almost $100,000. The national average […]

What was Australia’s top-selling vehicle in 2021?

Some of us buy cars for work, others for play. So it’s no surprise that the top two cars in 2021 can do both. But which vehicle took the crown? Well, it was super […]

Homeowners nearly four years ahead on their mortgage repayments

Australian homeowners are loading up their offset accounts in record amounts, so much so that the average household is now almost four years ahead on their mortgage payments. Quick question: do you have an […]

2022 forecast: places where housing prices aren’t slowing down

National housing values grew 22.1% in 2021, and there are two capital cities and one region in particular that are not ready to slow down just yet. Can you guess where? Happy New Year […]

Three (financial) New Year’s resolution ideas

Cut calories, increase your steps, abstain from alcohol: each year we set ourselves some pretty lofty New Year’s resolutions, most of which are doomed to fail. So why not add a nice straightforward financial […]

Season’s greetings! Here’s to a prosperous 2022!

To all our terrific clients: thank you for your ongoing support and for being such wonderful, loyal clients. We are always so appreciative of any opportunities – be they big, small, or anywhere in […]

Up to 4,600 first home buyer guarantees back up for grabs

Want to buy your first home with a deposit of just 5% and pay no lenders’ mortgage insurance? You could be in luck – the federal government will soon reissue up to 4,651 unused […]

How many SMEs find it difficult to repay business loans?

Ever thought about taking out a loan for your business but hesitated because you were worried about meeting your repayments? Don’t worry, it’s a common concern. But some promising data has just come out […]

Don’t drown in Buy Now Pay Later debt this Christmas

Christmas is fast approaching and there’s a good chance you’ve started turning your attention to gifts for family and friends. But be careful this silly season: more than half of Buy Now Pay Later […]

FOMO factor: more Aussies looking to buy with mates or siblings

Ever thought about buying a property with a friend or family member? You’re not the only one. The rising cost of property and FOMO has led to more than a quarter of Australians considering […]

Are your cashflow needs in order ahead of the summer trading season?

The summer trading season poses a raft of tricky cashflow and stocking challenges for retailers at the best of times, let alone following a global pandemic slowdown. But if done well it can set […]

How well has your salary kept up with house prices?

You’ve probably noticed that house prices in Australia consistently outstrip growth in wages. But by how much? And what can you do to make sure you’re not forever chasing the great Australian dream? Each […]

Think property prices will dip when rates rise? Don’t bet the house on it

Whether you’re looking to buy, sell or hold, there’s a good chance you’ve wondered whether the property market will tumble when interest rates rise, right? Today we’ll look at what happened to house prices […]

How to protect your business and your customers from scams

When you pay a supplier or service provider, are you certain you’re paying the right account? You’ve got to be super careful these days, as scammers are compromising inboxes and requesting payments to a […]

Open banking is ramping up, so how are lenders using your data?

Open banking is here and it’s charging full steam ahead. So just how are lenders and fintechs using your shared data in this brave, new, data-fuelled world? A new report has shed some interesting […]

Wheels in motion: RBA paves the way for early cash rate rise

Mortgage holders are facing a sooner-than-expected cash rate rise after the Reserve Bank of Australia (RBA) revised its outlook due to the economy bouncing back strongly from the Delta outbreak. So just how soon […]

Netflix and too chill: house hunters cutting corners on inspections

More than half of Australian house hunters spend the same amount of time inspecting a property as they do watching an episode on Netflix, according to new research. We get it. You see a […]

Are you relying on a personal credit card for business expenses?

We’ve all been guilty of the odd credit card mix-up from time to time – it happens! But if you’re consistently relying on a personal credit card to pay your business expenses – like […]

Seismic shift: two major banks hike fixed interest rates

Are the days of ultra-low fixed interest rates over? It’s looking increasingly so, with two major banks increasing their fixed rates this week. So if you’ve been thinking about fixing your mortgage lately, it […]

How 1-in-10 first home buyers cracked the market 4 years sooner

Almost 33,000 Australians bought their first home four years sooner thanks to two federal government schemes that give first home buyers a leg up into the property market. Could you, or someone you know, […]

SME lending options are on the rise, but how do you access them?

While many SME owners worry about their access to finance, a surge of new lenders and products is rapidly expanding the options available. And brokers have an important role to play for businesses, says […]

Bar raised for borrowers: tougher home loan serviceability tests

Some borrowers will soon find it harder to get a mortgage after the banking regulator announced tougher serviceability tests for home loans. So who will they impact most? The Australian Prudential Regulation Authority (APRA) […]

Is a home loan lending crackdown on the horizon?

The federal treasurer has given the strongest indication yet that a home loan crackdown is coming, stating that “carefully targeted and timely adjustments” may be necessary to avoid troubled waters. So what could a […]

Only half of SMEs have recently been able to secure full funding: report

Almost one-in-two SMEs have applied for new funding in the last six months, a new report has found, and of those SMEs only half were successful in obtaining the full amount they were seeking. […]

Top 5 property investor trends for 2021-22

With house prices going gangbusters in the first half of 2021, is it still a good time to buy property? The majority of investors think so, according to the latest annual survey. And investors […]

Are you too loyal for your own good? The banks think so

The average Australian homeowner is paying more than $37,000 in extra interest over the life of their home loan due to the loyalty tax, and it’s got three-quarters of borrowers feeling “ripped off” and […]

Refinancing figures are on a record-breaking run: here’s why

With interest rates at record low levels, the number of homeowners refinancing skyrocketed to an all-time high in July. Today we’ll run you through why so many people are refinancing, and why you should […]

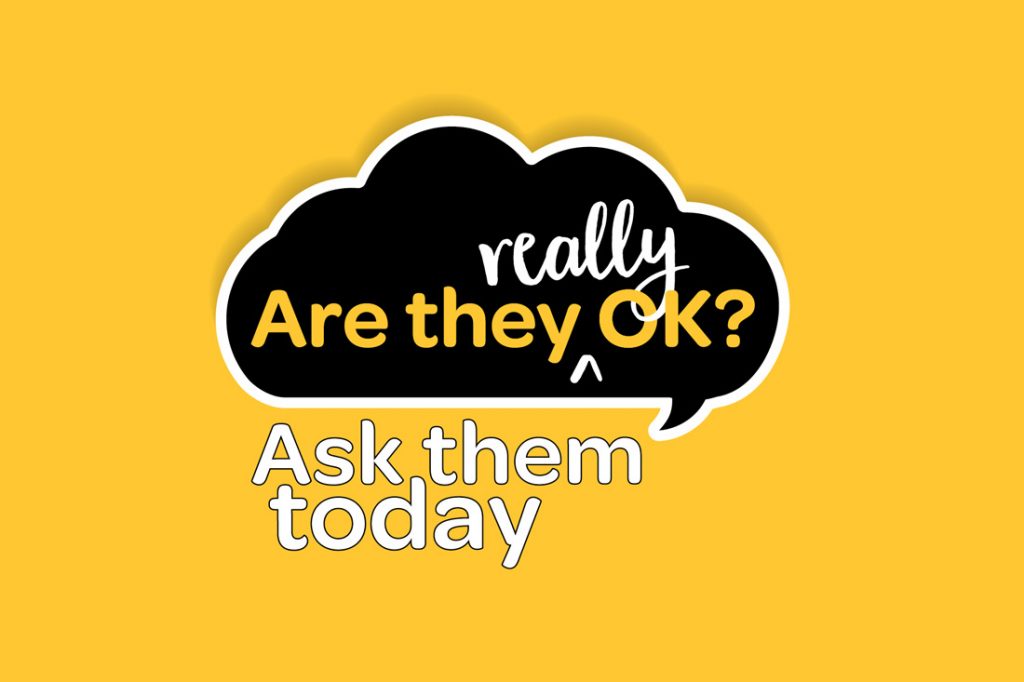

Are they really OK? Here’s how to check in with them today

Do you know how the people in your world are really doing right now? Chances are you know someone who’s doing it tough, but silently pressing on. As always, we’re here to support you, […]

Nine in 10 FHBs trust brokers to help them buy their first property

Remember that classic TV ad: ‘nine out of 10 dentists recommend using [toothpaste brand]?’ Well, it turns out we’ve earned a similar level of trust when it comes to helping first home buyers sink […]

How to ease financial pressure through debt consolidation

With many people around the country doing it tough right now, this week we’ll look at a way you can take some pressure off your monthly finances through debt consolidation. Here’s a quick experiment. […]

SME Recovery Loan Scheme revamped to help more businesses

More small and medium-sized businesses struggling to stay afloat due to the economic impacts of COVID will have access to cheaper funding after the federal government expanded the eligibility criteria for the SME Recovery […]

COVID hardship and grant options that could help you

With the pandemic once again tightening its grip around many parts of Australia, today we’ll run you through hardship and grant options that could be available to you or your business. Setting all politics […]

New super laws: a timely reminder to check your life insurance policy

What measures do you have in place to help protect your family home or business? If life insurance through your superannuation account is one of them, then it’s a good time to give it […]

House price growth hits 17-year high, but is it slowing down?

You’d have to go all the way back to the 2004 Athens Olympics to find a time when house price growth was faster than it has recently been. But latest data suggests the golden […]

Buy Now Pay Later users put on notice by credit agency

Do you use a Buy Now Pay Later (BNPL) service like Afterpay or Zip? If so, be warned that one leading credit reporting agency has made a big change that means your BNPL data […]

Let’s go shopping: Is now the time to refinance?

Let’s go shopping: Is now the time to refinance? Australia’s cash rate is at its lowest level in history. Does that mean the time is right to make the most of the low cash […]

Getting It Together: What to know before you consolidate

Getting It Together: What to know before you consolidate Managing multiple loans can be difficult – and stressful. One way to simplify your financial situation and save yourself time, effort and (hopefully) money is […]

Concerned About Servicing Your Loans

Concerned about Servicing your Loans? If you are concerned about servicing your loan, reach out to your local mortgage broker for help. As Australians everywhere take a close look at their financial circumstances, mortgage […]

To Rent or to Buy

To Rent or to Buy It’s a dilemma that may seem hard to resolve. To help you make your decision, we weigh up some of the pros and cons of renting a home, buying […]

Five Things You Need To Know Before Becoming A Rentvestor

Five Things You Need To Know Before Becoming A Rentvestor Rentvesting – renting a property to live in while owning one or more investment properties – is becoming an increasingly popular way for Australians […]

Four Questions Every Property Buyer Should Ask Their Real Estate Agent

Four Questions Every Property Buyer Should Ask Their Real Estate Agent If you are buying a new home or investment, chances are you will be attending a lot of open houses and meeting a […]

The Parent Trap: Should You Loan to Your Kids to Help Them Buy?

The Parent Trap: Should You Loan to Your Kids to Help Them Buy? The average age of first home buyers keeps increasing, with more young people turning to their parents for financial help. But […]

Ten Questions to Ask a Mortgage Broker

Ten Questions to Ask a Mortgage Broker Using a mortgage broker to help you choose a home loan can save you considerable time and could result in huge savings. However, before you decide on […]

Refinancing Could Save You Thousands – and Give You Greater Flexibility

Refinancing Could Save You Thousands – and Give You Greater Flexibility What Is Refinancing? Refinancing is the process of replacing an existing loan with a new one. When it comes to home loans, it […]

The Small Owner’s Definitive Guide To Equipment Finance

The Small Owner’s Definitive Guide To Equipment Finance Small businesses can always benefit from an upgrade to existing equipment or from purchasing the very latest technology or machinery. However, the reality is that many […]

Did you know… about non-bank lenders?

Did you know… about non-bank lenders? Deciding where to go for your home loan is one of the most important decisions you’ll make. While many prospective property owners will choose to use a mainstream […]

5 Reasons to consider a white label loan

5 Reasons to consider a white label loan A white-label loan is essentially a home-branded loan, much like the home-branded products you see in the supermarket aisles. Like these products, white-label loans aim to […]

What you can borrow or what you should borrow?

What you can borrow or what you should borrow? The amount you can borrow and the amount you should borrow are sometimes two very different things. Before you apply for a home loan, it […]

Fixed, variable, split – find the right fit for you

Fixed, variable, split – find the right fit for you In Australia, there are a number of ways to structure your home loan repayments. Finding the best option may save you time and money […]

How redraw works and why it’s a handy loan feature

How redraw works and why it’s a handy loan feature It’s one of the less glamorous home loan features, but the redraw facility deserves a second look. Here’s why: The redraw facility explained A […]

Seven things to look for when choosing your Mortgage Broker

Seven things to look for when choosing your Mortgage Broker When it comes to one of the biggest financial decisions you’ll ever make, it pays to have some professional help. But how do you […]

Mortgages and Breakups: Some practical tips when separating

Mortgages and Breakups: Some practical tips when separating Breaking up is hard to do. On top of the emotional impact, there are practical ramifications as well. When there’s a separation or divorce, debts you’ve […]

How to get the most out of Refinancing

How to get the most out of Refinancing Everyone wants to pay less on their mortgage, and refinancing is one strategy to help lower your interest rates – but is it worth it? We […]

Say goodbye debt (and hello home loan) in seven straightforward steps

Say goodbye debt (and hello home loan) in seven straightforward steps It’s all too easy to rack up debt – credit cards, HECS, car loans – and may seem all too hard to pay […]

How to instil financial smarts in your kids

How to instil financial smarts in your kids Worried about your kids not mastering the skills to manage their finances as adults? These tips for parents will help children develop good financial sense from […]

When the auction is passed in – to you! What happens next?

When the auction is passed in – to you! What happens next? The hammer falls, the auction has ended, the bidding’s all done… and the property is passed in to you, the highest bidder. […]

Understanding which home loan features are right for you

Understanding which home loan features are right for you Loans are by no means ‘one size fits all.’ Different loan types suit different age groups, different living situations and even different attitudes to money. […]

Buying property with other people: Mine, yours or ours?

Buying property with other people: Mine, yours or ours? When people buy property together, particularly if it’s with a partner or spouse, they often register the title in both people’s names – especially if […]